Benefits when the US recognizes Vietnam as a market economy

On May 8.5.2024, 26.7.2024, local time, the US Department of Commerce listened to an online debate in Washington DC on whether to recognize Vietnam as a market economy or not. The hearing is part of the review process, with a final decision due on July XNUMX, XNUMX.

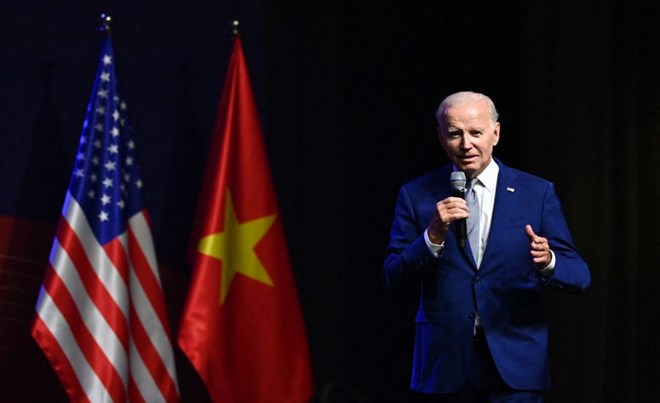

US President Joe Biden at a press conference in Hanoi on September 10.9.2023, XNUMX. Photo: AFP

During the hearing, Attorney Eric Emerson of Steptoe LLP – representing Vietnam’s Ministry of Industry and Trade – argued that Vietnam should be upgraded to a market economy because it has met 6 criteria of the US Department of Commerce.

“Vietnam has demonstrated performance in these criteria as good or often better than other countries that have been granted market economy status” – said Lawyer Eric Emerson.

In the argument, Vietnam believes that the non-market label should be removed because there have been recent economic reforms and being labeled a non-market economy is not good for Vietnam-US bilateral relations.

Supporting the US recognition of Vietnam as a market economy, Mr. Scott Thompson – Public Policy Director of Samsung Electronics US branch – said that Samsung Electronics Company has become one of the largest employers in Vietnam. Nam thanks to Vietnam’s market-oriented changes.

“Vietnam has emerged as a stable, safe supply chain partner of the US, bringing ultimate benefits to the US economy” – he said.

At the hearing, opposing parties argued that Vietnam’s policy commitments have not been matched by actions, and were concerned about Vietnam’s industries being heavily dependent on investment and imports. Input materials from China, many of which are subject to anti-dumping duties by the US.

Mr. Jeffrey Gerrish – former trade official of President Donald Trump’s administration, representative of steel manufacturer Steel Dynamics – said that the US recognition of Vietnam as a market economy will lead to a wave of non-commercial imports. fairness from Vietnam, thereby creating a foundation for China to avoid taxes in the US.

Currently, Vietnam, along with China, Russia, Belarus, Azerbaijan and 9 other countries, are on the list of non-market economies. This year, the US International Trade Commission extended the 25,76% anti-dumping tax on frozen farmed shrimp from Vietnam, while the tax on shrimp from Thailand – a market economy – is only at level of 5,34%.

At the press conference of the Ministry of Foreign Affairs of Vietnam on the afternoon of May 9.5, Spokesperson Pham Thu Hang welcomed the hearing of the US Department of Commerce on May 8.5.

“This is an important step in the process of reviewing the application for recognition of Vietnam’s market economy status” – Ms. Hang said.

A spokesperson for the Ministry of Foreign Affairs emphasized: “At the hearing, the Vietnamese side clearly stated arguments, information and data confirming that the Vietnamese economy completely meets the criteria of market economy regulations. market, while emphasizing that Vietnam’s economy is even doing better than many economies that have been recognized as market economy.

The representative of the Ministry of Foreign Affairs of Vietnam pointed out that up to now, 72 countries have recognized that Vietnam has a market economy, including large economies such as England, Canada, Australia, Japan… Vietnam has also recognized that Vietnam has a market economy. participating in 16 bilateral and multilateral free trade agreements with more than 60 partners across continents.

“The US’s early recognition of Vietnam’s market economy status will contribute to concretizing the commitments of the two countries’ senior leaders, strengthening the comprehensive strategic partnership between Vietnam and the US, thereby promoting Economic and trade relations bring practical benefits to businesses and people of the two countries” – The spokesperson emphasized.

Commenting in Deutsche Welle, Ms. Trinh Nguyen – senior economist in charge of emerging Asia at Natixis, a branch bank of the French banking group BPCE – emphasized: “Recognizing the economy The market helps Vietnam avoid US anti-dumping taxes, so if this status is recognized, Vietnam will make its products more competitive.”

Ms. Trinh Nguyen added: “The US is a key market, so being recognized as a market economy will help Vietnam.”

Source: https://laodong.vn/the-gioi/loi-ich-khi-my-cong-nhan-viet-nam-la-nen-lanh-te-thi-truong-1338417.ldo